Investing in gold and silvers is becoming a well-liked choice for retired life financial savings.

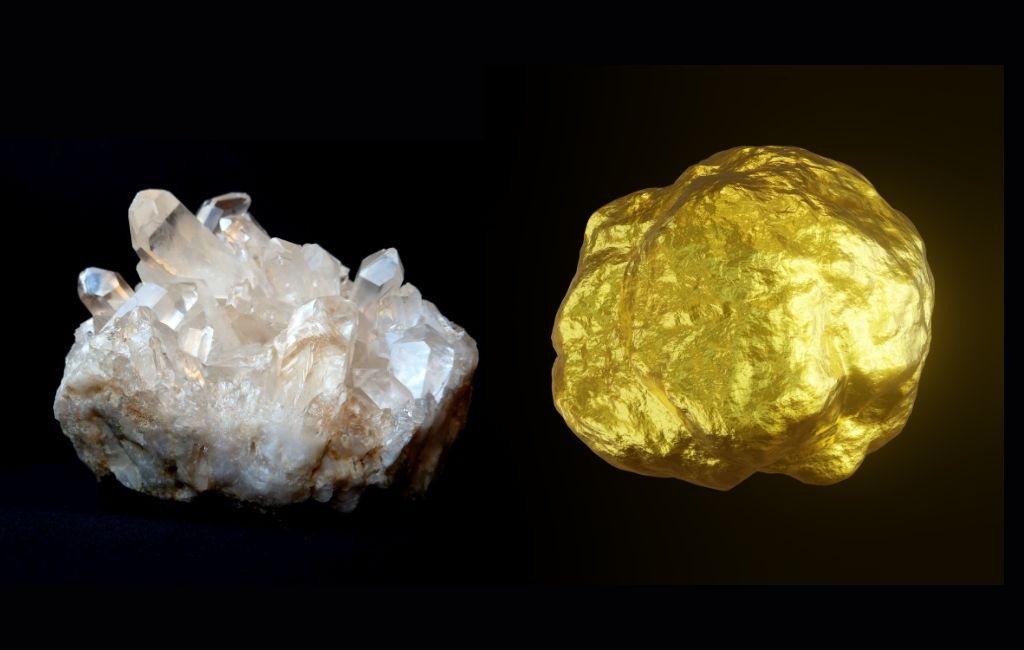

A rare-earth elements IRA is actually a form of Individual Retirement Account that permits clients to buy and also hold physical gold, silver, and also various other precious metals. This form of retirement account gives lots of perks, consisting of tax-deferred development, diversification, as well as security coming from rising cost of living.

When thinking about a precious metals ira companies, it is essential to find a reliable metals IRA custodian. A custodian is actually the banks that keeps and provides the funds in an IRA.

There are actually a variety of gold and silvers IRA managers on call, so it is necessary to carry out your study and also pick the one that best meets your necessities. The method of buying a metals IRA is reasonably easy.

To begin, you need to choose a gold and silver IRA custodian and create an account with them. After that, you will need to have to select the metals you prefer to purchase, such as gold, silver, platinum, or palladium. Your protector will certainly after that acquire the steels on your behalf as well as shop them in a secure vault.

In recap, a precious metals IRA is an excellent option for retirement life discounts. It uses tax-deferred growth, diversity, as well as security coming from inflation. When picking a manager for your precious metals IRA, it is very important to carry out your analysis and choose the one that greatest fulfills your necessities.

Along with the correct custodian, you can appreciate the advantages of a precious metals IRA for years to follow.

Firms Reputation And Legitimacy

Gold IRAs have come to be considerably preferred throughout the years and once and for all main reason. As a retirement investment possibility, they supply a safe haven for people wanting to transform their collections and safeguard their wealth.

Having said that, it’s important to choose a respectable gold and silvers IRA firm to make sure validity and also stay away from frauds.

When searching for metals IRA firms, it is actually vital to do your due carefulness and research each possible business carefully. Try to find reviews from professional resources and consider the company’s past, adventure, and also certification.

Additionally, are sure to read through their policies as well as treatments to guarantee they align along with your expenditure goals and worths.

One more element to take into consideration when picking a precious metals IRA company is their customer care. A dependable and also trustworthy business will certainly have competent and also receptive agents to assist you with any kind of questions or worries you might have.

Generally, gold IRAs are a legitimate as well as important assets possibility for retired life preparing. Nevertheless, it’s important to choose a reliable metals IRA firm to ensure the security and legitimacy of your expenditure.

By performing your research and as a result of carefulness, you may with certainty buy a provider that lines up along with your financial objectives and market values.

What Is A Precious Metals IRA?

A precious metals IRA is actually a form of ira where the capitalist holds metals, including gold, silver, platinum, and also palladium, rather than paper possessions like assets and connections. The steels are actually kept in a secure vault, which is actually permitted due to the IRS.

This sort of IRA is actually preferred through entrepreneurs that are looking to diversify their collections and shield their wide range versus inflation as well as economic recessions. Precious metals IRAs are also beneficial given that they deliver tax benefits comparable to typical IRAs.

It is essential to take note that certainly not all metals are actually allowed an IRA, and also the coins and also clubs must comply with details fineness requirements. Moreover, fees and expenses associated with a gold and silvers IRA can easily differ depending on the provider giving the solution.

As with any type of assets, it is necessary to carry out complete study and also speak with a financial expert just before making any sort of choices.

How We Ranked The Top Precious Metals Investment Companies

Rare-earth elements IRA custodians participate in a vital job in the investment market through aiding individuals diversify their profiles along with gold and silvers. The ranking of metals IRA managers is actually crucial when it concerns picking the appropriate one for a capitalist’s needs.

Numerous factors are actually looked at when positioning the business, consisting of image, fees, customer service, and total adventure.

The top rare-earth elements IRA custodians have gotten high results for their reduced expenses, superb customer support, and clarity. Real estate investors are actually promoted to carry out their analysis just before picking a gold and silvers IRA custodian to guarantee they pick the right one for their monetary targets.

It is actually important to take note that the rank of gold and silvers IRA custodians might transform gradually, as the business is continuously advancing. As a result, it is actually critical to stay enlightened and also current on the latest positions as well as field styles.

Collaborating with a respectable precious metals IRA manager may deliver real estate investors with peace of mind and also help them attain their economic purposes.

Searching for A Broker Or Custodian For Your Precious Metals Based IRA

While this kind of assets can provide a bush versus inflation and also financial uncertainty, it is actually essential to collaborate with a broker or custodian that focuses on precious metals IRA custodianship to make certain that the investment abides by IRS regulations.

A broker or even protector participates in a vital duty in taking care of a metals IRA. They assist capitalists navigate the complicated policies as well as rules bordering metals IRAs, including storing needs, tax reporting, and also circulation guidelines.

Also, they deliver clients with accessibility to a large variety of investment options, including pieces, bars, and gold.

To locate a professional rare-earth elements IRA manager, entrepreneurs should start through doing their due persistance. It is necessary to select a custodian that is trustworthy, experienced, and also possesses a proven performance history of results.

Financiers may investigate managers online, inspect their scores with the Better Business Bureau, as well as review assessments coming from various other investors.